A campaign to hold predatory vulture hedge funds accountable through New York State law.

The Problem

“Vulture funds” are predatory Wall Street investors who purchase debts owed by struggling countries, sometimes for pennies on the dollar, to then demand full repayment and sue countries through New York courts.

Vulture Funds swoop in when they know debt is no longer sustainable, purchase it at a discounted price, and sue the countries.

Vulture funds often secure billion dollar debt payments to enrich themselves while communities face poverty, leading to cuts in essential services.

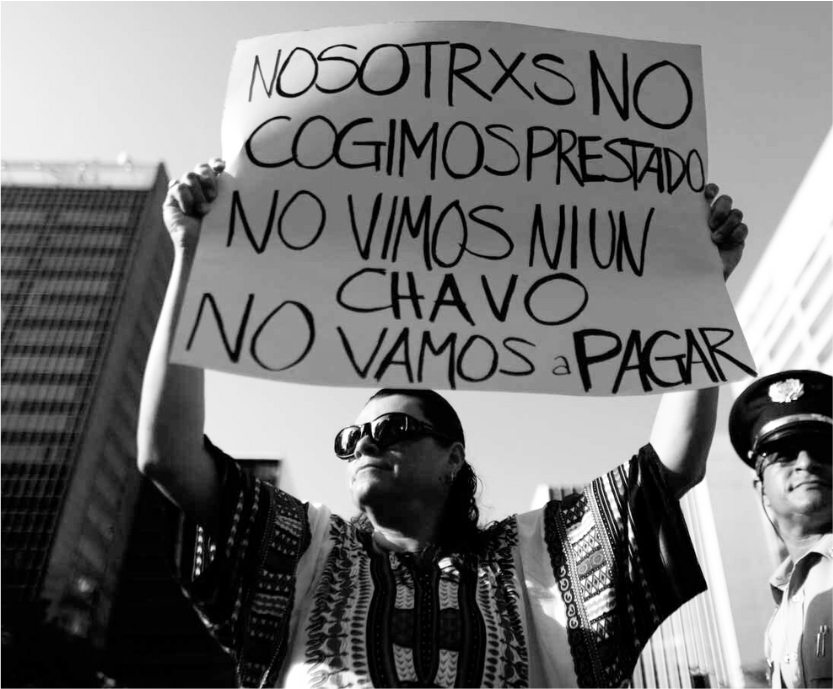

Nations affected by the Vulture Funds predatory practices like Argentina, Venezuela, Ecuador, Puerto Rico and the Republic of Congo have to implement austerity measures to pay these wealthy vultures. Under austerity, governments reduce spending by cutting access to services.

For the people of these nations, this has meant job losses, school closings, hospital closings, the deterioration of labor rights and pension funds, crumbling infrastructure, and sometimes extreme food scarcity.

Because around half the world’s sovereign debt is governed by New York law, vulture funds rely heavily on favorable legal judgments from federal courts in New York. New York State is home to over 4 million immigrants, many of whom are from the very countries facing this vulture fund greed.

New Yorkers and their families have experienced this destabilization first hand and stand to benefit from vulture funds being held accountable.

Legislation

Around half of sovereign debt contracts are governed by New York law, our state is uniquely positioned to disrupt the vulture fund playbook, making debt markets operate more fairly and sustainably, while improving both financial and political stability for affected nations.

Lawmakers in New York state must take action to end predatory financial behavior by passing the following bills:

(S1477 Krueger/A643 González-Rojas)

The Champerty Doctrine prohibits the purchase of securities or other financial instruments solely for the purpose of litigation. As the law currently stands, vulture funds are able to grind down debtor countries in extended cycles of litigation.

The bill would strengthen Champerty by making clear that it is unlawful for vulture funds to use New York law to profiteer from the distressed debt of struggling countries. Additionally, it would eliminate a current loophole that exempts transactions over $500,000.

This bill would create a bankruptcy-like process that allows countries to negotiate down their debt without being blocked by a predatory minority of debt-holders. The bill would allow debtors to select one of two mechanisms to ensure a fair and efficient restructuring of distressed debt.

Like bankruptcy, it would create an orderly, sovereign bankruptcy regime that would ensure that if a supermajority of lenders agreed to renegotiate the terms of a contract, the dissenting minority would not be able to sabotage the process.

For countries participating in the second mechanism, debt will only be recoverable for creditors if they meet burden-sharing and disclosure standards, and the amount of money private creditors could recover would be capped to the same level that has been agreed to by sovereign lenders.

What’s at stake

The economic strain imposed by vulture funds leads to austerity measures that slash vital services like healthcare, education, and social safety nets.

Countries under heavy debt burden often face cuts to investments in climate resilience and environmental protection, making them more vulnerable to natural disasters, like fires, floods and hurricanes.

Many New Yorkers in immigrant communities come from countries affected by vulture funds. Poverty and limited economic opportunities, exacerbated by heavy debt repayments, drive people to seek better prospects abroad. Addressing these root causes could help reduce migration pressures.

Austerity measures imposed by debt restructuring programs directly harm workers’ rights, suppress wages, and reduce job opportunities at a time when layoffs increase.

Cuts to public health services lead to higher rates of preventable diseases and worsen health outcomes, disproportionately affecting vulnerable populations.

Publications

Media

About Us

The Debt Justice Alliance includes New York-based organizations the Center for Popular Democracy (CPD), Churches United for Fair Housing, New York Communities for Change, Hedge Clippers, and Strong Economy for All.

Our organizations work with immigrant communities across the state who have experienced first-hand the negative impact of austerity measures resulting from the predatory practices of vulture funds.